Chemistree Technology Inc. (OTC:CHMJF) (CSE:CHM) Is Growing Through Smart Branding And Intelligent Acquisitions

Micro-cap companies (valuations under $100 million) are always fun to analyze and investing in them are often more profitable for investors than large companies as long as investors can handle the volatility. Most of these companies do not have the executive depth, financial resources nor the cash flow large companies typically have.

Amid this surging pot sector, there is one micro-cap company standing head over heels above the rest. This company has the unique characteristics much larger and more established companies with higher valuations have and could potentially produce explosive returns if they execute their business and marketing plan.

Chemistree (OTC:CHMJF) (CSE:CHM) is building upon the momentum it has earned with its latest funding round for CAD $10.83 million. With their recent announcements of the additions of industry experts Nico Escondido from High Times and CCO Sheldon Aberman, the company is positioned to “grow” and build out their two new massive manufacturing and distribution facilities (totalling 128,000 sq feet) in Desert Hot Springs, California.

Pot Perfected

Supreme’s been wildly successful with its 7Acres brand, but similarly with its Sugarleaf brand, Chemistree (OTC:CHMJF) (CSE:CHM) has worked to establish a premium pot strain in Washington state, Sugarleaf products can currently be found in over 50 dispensaries across its home state.

Chemistree (OTC:CHMJF) (CSE:CHM) expects Washington state production to increase to 3,000 lbs by 2019, from 1,938 lbs in 2017, representing a 55% jump in production capacity in just two years. Moreover, Washington is projected to show solid revenue growth and targeting to double its revenue by 2019. The company projects to achieve $1.60 million and $2.70 million in revenue in 2018 and 2019, from $1.37 million revenue in 2017.

Through an expansion into two Desert Hot Springs 64,000 sq foot facilities (128,000 sq feet in total), Chemistree (OTC:CHMJF) (CSE:CHM) plans to aggressively expand Sugarleaf’s footprint into the largest US pot market of California.

‘multi-state operator (MSO) strategy, much like GTI, but is at an earlier stage’

Many investors will be able to see a similarity between the business strategy of Chemistree (OTC:CHMJF) (CSE:CHM), which has begun to establish its own vertically-integrated empire, and that of similar to Green Thumb Industries. Building out brands like Sugarleaf, and building out a proposed state-of-the-art extraction facility in California, Chemistree has a multi-state operator (MSO) strategy, much like GTI, but is at an earlier stage, with plenty more room to grow, as it expands into new markets.

Chemistree has completed two acquisitions totaling US$4.5 million in purchase and committed development capital and once the deal for the Northern California Processing Facility is closed, Chemistree (OTC:CHMJF) (CSE:CHM) plans to produce an array of Sugarleaf branded products. Having the capability for mass processing provides Chemistree with the ability to give immediate access to the lucrative California market for the Sugarleaf brand.

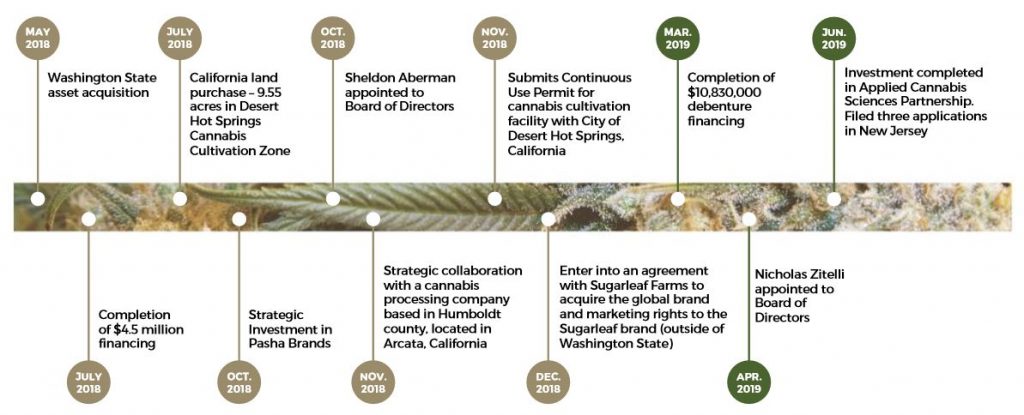

Chemistree (OTC:CHMJF) (CSE:CHM) has made a strategic move to get ahead of the crowd into the state of New Jersey recently announced , as it signed a deal with Applied Cannabis Sciences a medical retail dispensary applicant in the upcoming New Jersey round of request of applications (RFA), which is anticipated in 2020. The New Jersey market has been touted as having an additional $1.5 billion potential[1].

Sugarleaf Strains Winning Major Awards

In May of 2018, Chemistree (OTC:CHMJF) (CSE:CHM) made the strategic acquisition of the Washington-based assets and global branding rights of premium potproducer Sugarleaf.

For the highly economic purchase price of just US$1 million, Chemistree (OTC:CHMJF) (CSE:CHM) acquired leasing operational assets, such as lights, equipment and more, while also gaining subleasing turnkey facilities, and the ability to market existing and popular brands.

How popular? Two of Sugarleaf’s strains – White 99 and Presidential Kush – have won accolades in the world’s most prestigious pot competition including ‘Best US Hybrid’, ‘Medical Hybrid’, and ‘People’s Choice Cup’ categories.

The brand could soon see massive hockey stick growth as it is slated to be soon offered in the much larger California market once Chemistree (OTC:CHMJF) (CSE:CHM) Desert Hot Springs facility is in operation.

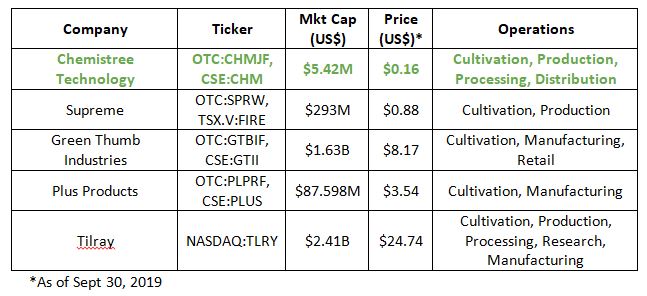

Compared to others in the vertically integrated space, Chemistree (OTC:CHMJF) (CSE:CHM) has an unbelievably low market cap of only USD $5.42 million. With slightly over 34 million shares issued, Chemistree could potentially bring a lot of value and big profits in the upcoming months.

The entire sector has taken a hit in the last six months, however Chemistree (OTC:CHMJF) (CSE:CHM) has weathered the storm better than its competitors, namely industry giant Tilray. Tilray has lost a whopping 78.9% on its share price since April 1, 2019.

Sometimes, losses are good. In an industry like pot, which is poised to continue growing for at least the next 5 years, a slight share price drop can present an opportunity for savvy investors to get in at undervalued prices. Especially when that share price drop is miniscule compared to the industry as a whole.

Swinging In The Right Direction

When an entire market takes a downturn, a better assessment of a company’s health is how its downturn is going relative to competitors. As mentioned, Chemistree (OTC:CHMJF) (CSE:CHM) is doing significantly better than the competition in this regard. Given the recent downswing and the fact that the pot sector as a whole most definitely is not going to keep contracting, right now is the perfect time for investors to do their due diligence.

What the trends are suggesting is that Chemistree (OTC:CHMJF) (CSE:CHM) unique business model of growing through acquisition and development of vertically-integrated assets is working.

More specifically, it has been quietly buying valuable assets at cut-rate prices—including the award-winning premium pot brand, Sugarleaf, based out of Washington State; prospective pot cultivation lands in California; a Canadian pot market investment through Pasha Brands; an early-mover partnership with a New Jersey-based medical retail dispensary applicant; and a robust pipeline of additional assets in progress.

Multi-State Expansionary Strategy

the potential addition of a presence in New Jersey in 2020 via their partnership with an early applicant in that state’s licensing process, Chemistree (OTC:CHMJF) (CSE:CHM) would have a footprint spanning three US states. Perhaps more important is their upcoming entry into the California market which has been projected to be worth $6.59 billion by 2025—accounting for more than a quarter of the entire nation’s sales.

The strategy of the California expansion is multifaceted, highlighting the company’s confidence in the Sugarleaf brand. By setting up operations in California, on the 9.55-acre site of what will be a significant cultivation and production facility, Chemistree (OTC:CHMJF) (CSE:CHM) will have ample room to grow pot and its proprietary brands. Management managed to acquired this property at just over US$1.2 million.

Within Sugarleaf’s home state of Washington, Chemistree (OTC:CHMJF) (CSE:CHM) currently have their products in more than 50 retail stores. Their big expansion plan includes quickly increasing that presence to more than 200 stores while introducing additional product lines and expanding offerings within current brands. From just the single cultivation facility in Washington state, Chemistree (OTC:CHMJF) (CSE:CHM) has targeted nearly 4,000 lbs of cultivated product, which would yield an estimated $3.5 million in revenue.

The Washington facility has 5,000 sq feet of indoor operations, but the company has announced that this footprint will be doubled in 2019. Over the eventual 10,000 sq ft total space, there will be processing operations, and a testing lab facility.

‘Operation would produce approximately 55,000+ pounds of cannabis per year’

The California facility site has development potential for more than 200,000 sq feet (128,000 to start) of greenhouse space across three separate buildings. Overall, at that size, the operation would produce approximately 55,000+ pounds of cannabis per year. These facilities will also be able to handle edibles, vapes, oils, concentrates, and tinctures.

Recruiting The Most Skillful Minds at the Top

Since the bulk of Chemistree’s (OTC:CHMJF) (CSE:CHM) successes have come from acquisitions and development, the company has accomplished this backed by its ability to raise funds. The management team has a collective track record of raising over $150 million in financing, being part of $130 million buyouts, and building companies with revenues over $50 million.

For Chemistree, they successfully utilized this experience to raise $4.5 million in private financing last July – which was more than double their initial goal of $2.1 million and recently in March 2019 closed another round of CAD $10.83 million.

Subsequent to the March raise, Chemistree’s (OTC:CHMJF) (CSE:CHM) sought out to bring on board the most well-respected industry experts to expand into California.

Here’s a quick look at some of the key figures behind Chemistree Technology Inc. (OTC:CHMJF) (CSE:CHM):

Karl Kottmeier: Leading the way on the financial side is President, Karl Kottmeier who has raised more than $150 million in equity capital over his 25+ years of financial industry experience. Central to this experience was his tenure with Rockgate Capital, which alone raised $75 million.

Karl Kottmeier: Leading the way on the financial side is President, Karl Kottmeier who has raised more than $150 million in equity capital over his 25+ years of financial industry experience. Central to this experience was his tenure with Rockgate Capital, which alone raised $75 million.

Sheldon Aberman: Industry leading cultivation expert and cannabis grow consultant Sheldon Aberman sits on Chemistree’s board and serves as the Company’s CCO. Aberman has managed and designed thousands of cannabis grows worldwide over his 17 years of experience in the industry including a 312,000 sq foot cultivation center in 2014. His product development has created leading edge commercial grow room designs. A master of his craft, Aberman has built several multi-million dollar brands, including Black Label and Frost Box.

Sheldon Aberman: Industry leading cultivation expert and cannabis grow consultant Sheldon Aberman sits on Chemistree’s board and serves as the Company’s CCO. Aberman has managed and designed thousands of cannabis grows worldwide over his 17 years of experience in the industry including a 312,000 sq foot cultivation center in 2014. His product development has created leading edge commercial grow room designs. A master of his craft, Aberman has built several multi-million dollar brands, including Black Label and Frost Box.

Beyond growing and design, Aberman also is an expert in the accessory market. He has been involved with the development of vape pens, e-cigarettes, silicon mats, and extraction tools. His well-earned reputation is known throughout the industry as one of the world’s foremost experts on commercial cannabis cultivation, and is sought after around the world for his input. He is one of the founders of Chemistree.

On the cannabis consultant side, joining Aberman are figures such as Senior Advisors, Dennis Hunter and David Brooke. Hunter’s built multiple cannabis companies with revenues of over $50 million in California, and is an organizer of a large cannabis growing collective in California. Brooke grew up in the family business through the company General Hydroponics, which sold to Scott’s Miracle Grow in 2015 for $130 million. Brooke’s expertise on the Chemistree team centers around his computer assisted design and 3D modeling skills, as well as his industry contacts in Northern California.

Nico Escondido: Perhaps the most prominent name among the company’s talented group, is the recently added Board Member, Nicholas J. Zitelli (aka ‘Nico Escondido’). Zitelli is part-owner, Director, and CCO of Trans High Corporation, which is the parent company for all HIGH TIMES brands which recently raised $10 million. Nico’s written hundreds of articles on all aspects of the pot sector, under the penname “Nico Escondido”, and has been appointed numerous times for committee, legislation, and policy consultation in numerous jurisdictions across North America and the EU.

Nico Escondido: Perhaps the most prominent name among the company’s talented group, is the recently added Board Member, Nicholas J. Zitelli (aka ‘Nico Escondido’). Zitelli is part-owner, Director, and CCO of Trans High Corporation, which is the parent company for all HIGH TIMES brands which recently raised $10 million. Nico’s written hundreds of articles on all aspects of the pot sector, under the penname “Nico Escondido”, and has been appointed numerous times for committee, legislation, and policy consultation in numerous jurisdictions across North America and the EU.

Why Chemistree Technology Inc. (OTC:CHMJF) (CSE:CHM) is a Micro-Cap Stock that could break out with their aggressive growth plans.

MULTI-STATE EXPANSION PLANS

With a presence already in Washington, and major plans underway for an expansion in California with two facilities totalling 168,000 sq feet, Chemistree (OTC:CHMJF) (CSE:CHM) is making a play to be the sector’s next significant multi-state operator (MSO). Through vertical integration, the company can bridge brands like Sugarleaf into multiple markets, through new product offerings and business consolidation. Chemistree (OTC:CHMJF) (CSE:CHM) plans to become a first mover in the New Jersey market through their partnership with an early license applicant.

PREMIUM STRAIN POTENTIAL

Chemistree (OTC:CHMJF) (CSE:CHM) acquired the global branding rights to the popular Washington-based premium pot brand Sugarleaf, along with leasing operational assets, and turnkey facilities. Two of the brand’s strains have already won the prestigious competitions in the ‘Best US Hybrid’, ‘Medical Hybrid’, and ‘People’s Choice Cup’ categories. The strain gives an expandable strategy across state lines for Chemistree, while the Sugarleaf brand is already found in over 50 retail stores, with aims to be in 200 by the end of 2019.

WEATHERING THE STORM BETTER THAN THE COMPETITION RIDING A WAVE OF POSITIVE MOMENTUM

Over the last month, Chemistree (OTC:CHMJF) (CSE:CHM) has been significantly better than its competitors at weathering the storm brought on by the downtick in the pot sector as a whole. While increased price performance is always desirable, this could represent a significant opportunity to buy while undervalued. Downturns also serve to sort the wheat from the chaff - Green Thumb had 24% of its market cap wiped out, Chemistree (OTC:CHMJF) (CSE:CHM) lost 3%. This suggests that Chemistree (OTC:CHMJF) (CSE:CHM) is in much better health than its most comparable competitor.

MANAGEMENT TEAM BUILT FOR GROWTH

Chemistree (OTC:CHMJF) (CSE:CHM) is built to grow, both financially, and structurally. Industry experts such as CCO Officer Sheldon Aberman and Director Nicholas J. Zitelli (aka ‘Nico Escondido’) are among the exceptional team of top pot minds. Financially, the company is in good hands with President Karl Kottmeier who has raised more than $150 million in equity capital over his career, and has a track record for building growth companies just like Chemistree.